How to Calculate Beta of a Portfolio

If 0 p exceeds 1 P the loss will be positiveIf 0 p is less than 1 P the loss will be negative which is another way of saying the portfolio makes a profit. Disclaimer and risk warning.

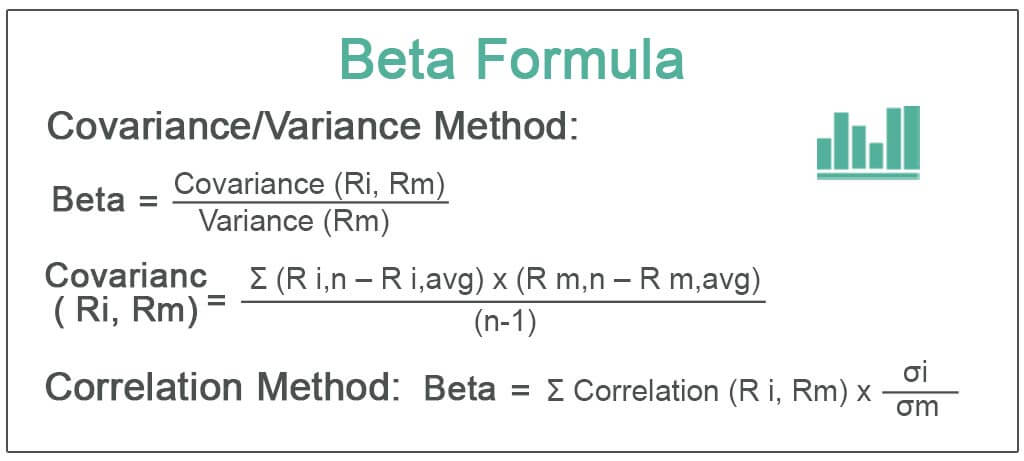

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole.

. It is used in the capital asset pricing model. Calculating CAPM Beta in the xts World. Lets say there are 2 securities in the portfolio whose standard deviations are 10 and 15.

Calculate your Portfolios Beta and Volatility with the functions as shown below. The Beta on financial pages. Assess the alpha and beta within equity funds.

Once we have the value for a single day we just need to copy and paste the formula across all. Expected return on an asset r a the value to be calculated. Estimate and analyze the value of bond assets.

Thus beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. Beta is a measure of the stocks volatility compared to the overall stock market Overall Stock Market Stock Market works on the basic principle of matching supply and demand through an auction process where investors are willing to pay a certain amount for an asset and they are willing to sell off something they have at a specific price. The Beta is calculated in the CAPM model CAPM Model The Capital Asset Pricing Model CAPM defines the expected return from a portfolio of various securities with varying degrees of risk.

The default index used for calculations is SPY PortfolioBetaPortfolio PortfolioVolatilityPortfolio. For instance if a companys beta is equal to 15 the security has 150 of the volatility of the market average. Beta β is a measure of volatility or systematic risk of a security or portfolio in comparison to the market as a whole.

Lets go to the xts world and use the built-in CAPMbeta function from PerformanceAnalyticsThat function takes two arguments. Most people use the SP 500 Index to represent the market Beta is also a measure of the covariance of a stock with the market. Evaluate the effectiveness of commodities money market funds and mortgage-backed securities.

A portfolio with a high beta means you may be risking more than you think you are. Value at risk VaR is used to calculate the maximum loss a. It is calculated using regression analysis.

Treasury billNo instrument is completely without some risk including the T-bill which is subject to inflation risk. Because we dont know the portfolios future value 1 P we dont know its loss 1 LBoth are random variables and we can assign them probability distributions. Calculating Value-at-Risk as a Quantile of Loss.

The portfolio allocation vector the 5 placeholder values with the daily security return series to calculate the portfolio return for a given day. Calculate contribution margin. This sound more scary than it is.

Cost of goods sold sales commissions and delivery expenses are examples of variable expenses. If you have a slightest of the hint regarding DCF then you would have heard about the Capital Asset Pricing Model CAPM CAPM The Capital Asset Pricing Model CAPM defines the expected return from a portfolio of various securities with varying degrees of riskIt also considers the volatility of a particular security in relation to the market. You can use a calculator or the Excel function to calculate that.

Variable expenses are those costs that increase with each incremental sale. If your portfolio has a beta of 15 and the market falls 10 your portfolio would be expected to fall 15. Subtract these expenses from total sales to calculate the contribution margin.

Read more Capital Asset Pricing Model for calculating the rate of return of a stock or. A beta of -1 means security has a perfect negative correlation with the market. It is used in the capital asset pricing model.

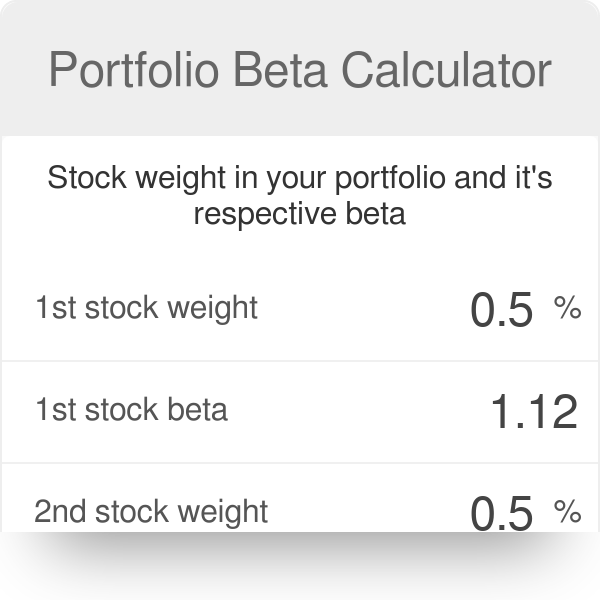

The beta of a portfolio is calculated as the weighted average of each components beta. Calculate the standard deviation of each security in the portfolio. However the T-bill is generally accepted as the best representative of a risk-free security because its return.

However if the beta is equal to 1 the expected return on a security is equal to the average market return. Risk-free rate r f the interest rate available from a risk-free security such as the 13-week US. While low-beta stocks pose less risk but also lower returns.

We can make things even more efficient of course with built-in functions. It also considers the volatility of a particular security in relation to the market. Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole.

The formula for Beta is Covariance divided by variance. In finance the beta β or market beta or beta coefficient is a measure of how an individual asset moves on average when the overall stock market increases or decreases. Optimize credit risk by choosing the right bonds for your portfolio.

Stock is more volatile than the market but expects higher return. The contribution margin is total sales less variable expenses. The returns for the portfolio or any asset whose beta we wish to calculate and the market returns.

Options Trading IQ Pty Ltd ACN 658941612 is a Corporate Authorised Representative 001296496 of Network Influencer Pty. Stock with lower volatility and expects less return. Multi-faceted Portfolio Analysis At Your FingertipsRisk-Return AnalysisUse a comprehensive list of risk and return analysis functions in your Excel.

First we need to calculate the standard deviation of each security in the portfolio.

How To Calculate Beta With Pictures Wikihow

How To Calculate Beta With Pictures Wikihow

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

No comments for "How to Calculate Beta of a Portfolio"

Post a Comment